Why Solana Powers The Insumer Model™

Transforming Customers Into Stakeholders

The future of consumer engagement isn’t about loyalty points or discounts — it’s about genuine ownership. The “Insumer Model™” represents a fundamental shift in how businesses can transform their customers from passive consumers into active stakeholders through tokenized equity. But this revolutionary approach hinges on one critical requirement: the blockchain infrastructure must deliver Web2-level performance. Without instant verification, negligible costs, and seamless user experience, the entire model collapses at the point of sale. This is where the choice of blockchain platform becomes not just important, but existential.

The Infrastructure Challenge: Where Most Blockchains Fail

The Insumer Model™ faces a deceptively simple challenge: making ownership verification feel as natural as any other retail transaction. When a customer buys a coffee or makes an online purchase, they expect instant confirmation. They don’t want to think about blockchain technology, gas fees, or transaction delays. They simply want their purchase confirmed and their benefits delivered — immediately.

This creates four non-negotiable technical requirements. First, ownership verification must happen instantly at every point of sale, creating retail experiences that feel natural and rewarding. Second, transaction finality must occur in sub-second timeframes with negligible costs to maintain commercial flow without friction. Third, the system must handle massive scale — think thousands of simultaneous verifications during peak shopping hours like Black Friday. Finally, the infrastructure must maintain 24/7 uptime with trustless, cryptographic verification that never requires customers to worry about downtime or maintenance windows.

What Success Actually Requires

Let’s be clear about what “instant verification” really means in practice: under one second to maintain retail flow and customer satisfaction. Any longer, and customers abandon their purchases. The cost structure must be equally uncompromising — under five cents per transaction, or the economics collapse entirely for everyday retail transactions. The system must handle massive scale, with 1,000+ simultaneous verifications during peak shopping hours becoming routine rather than exceptional. And perhaps most importantly, the user experience must be completely seamless — customers shouldn’t wait, shouldn’t think about blockchain technology, and should simply enjoy the benefits of ownership at every transaction.

These aren’t aspirational features or nice-to-haves. Performance isn’t just a competitive advantage — it’s the entire foundation upon which the Insumer Model™ stands or falls. Without instant, cheap verification, the model fails at the most critical moment: checkout.

Why Ethereum Can’t Support This Vision

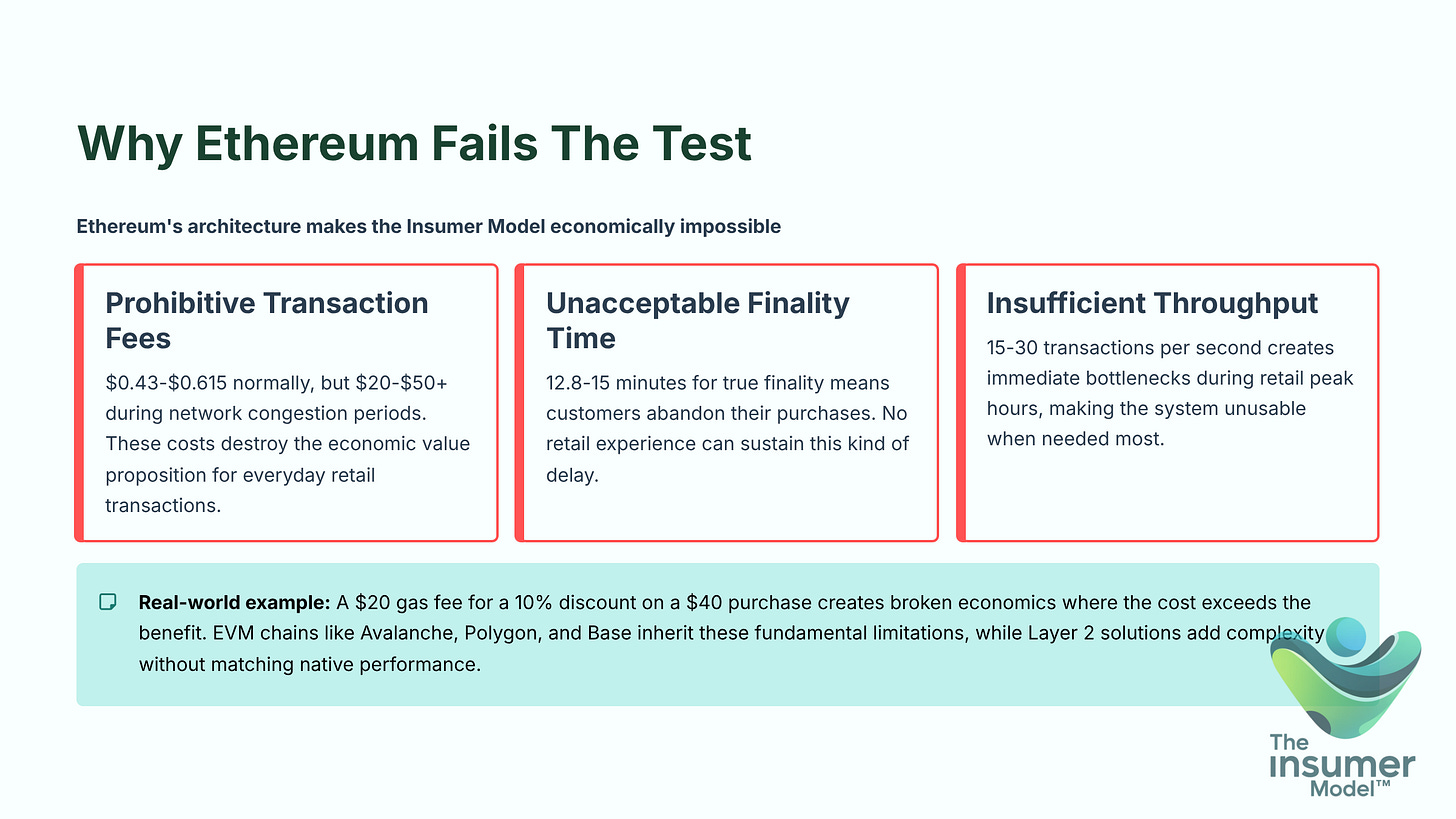

Ethereum, despite being the dominant smart contract platform, fundamentally cannot support the Insumer Model™ at scale. The numbers tell a stark story. Transaction fees on Ethereum typically range from 43 cents to over 60 cents normally, but during network congestion periods, they can spike to $20-$50 or more. These costs immediately destroy the economic value proposition for everyday retail transactions. Imagine offering a 10% discount on a $40 purchase, only to charge a $20 gas fee to verify ownership — the math simply doesn’t work.

The finality problem is equally catastrophic. Ethereum requires 12.8 to 15 minutes for true finality, meaning customers would need to wait a quarter of an hour for their purchase to be confirmed. No retail experience can sustain this kind of delay — customers will simply abandon their transactions and walk away. Even Ethereum’s throughput of 15–30 transactions per second creates immediate bottlenecks during retail peak hours, making the system unusable precisely when it’s needed most.

The harsh reality is that EVM chains like Avalanche, Polygon, and Base all inherit these fundamental limitations. Layer 2 solutions add complexity without achieving native performance parity with what’s actually required. A real-world example illustrates the problem perfectly: a $20 gas fee for a 10% discount on a $40 purchase creates broken economics where the cost exceeds the benefit.

Solana Delivers What’s Actually Required

Solana was purpose-built to solve exactly these problems. Its performance characteristics align perfectly with the Insumer Model’s requirements. Lightning finality of 400 milliseconds means verification happens faster than a human blink and remains imperceptible to customers during checkout. Transaction costs under one cent — typically around a fraction of a penny — make the economics viable for any purchase size, from coffee to luxury goods.

The throughput tells an even more impressive story. Solana handles 2,000+ transactions per second in real-world conditions and has been stress-tested at over 100,000 TPS for future growth. This isn’t theoretical capacity — it’s proven, battle-tested infrastructure. The platform maintains 24/7 uptime demonstrated through billions of transactions, with a purpose-built architecture designed specifically for high-performance applications.

The economic reality creates a sustainable model that actually works: spending one cent to verify ownership for 43 cents in savings creates unit economics that scale for both businesses and consumers. This isn’t marginal improvement — it’s the difference between a viable business model and an impossible one.

Regulatory Parity: The Final Barrier Falls

For years, Ethereum enjoyed a significant advantage: regulatory familiarity. When INX chose Ethereum in 2021 for tokenizing securities, it was largely because regulators understood it better than alternatives. That competitive moat no longer exists.

September 2025 marked a watershed moment when Galaxy Digital successfully tokenized Nasdaq-listed shares on Solana with full SEC approval — the first public equity on a major blockchain outside Ethereum. This achievement eliminates Ethereum’s regulatory advantage entirely. The playing field has been leveled.

Recent legislative developments have created comprehensive frameworks for tokenized equity. The GENIUS Act passed in July 2025, followed by the CLARITY Act, establishing clear regulatory pathways for innovative implementations. These frameworks make tokenized equity not just legally possible, but operationally straightforward.

The strategic insight is profound: when regulatory risk equalizes across platforms, technical performance becomes the deciding factor. Solana now has both the regulatory precedent and superior infrastructure. The choice becomes obvious.

Real Consumer Adoption: The Numbers Don’t Lie

Solana isn’t just theoretically superior — it’s winning mainstream blockchain adoption right now. The platform processes 2.9 billion monthly transactions, a volume that matched Ethereum’s entire lifetime total in just one month of August 2025. DEX volume reached $14.4 billion, up 180% year-over-year, demonstrating real economic activity rather than speculative trading.

The user base tells an equally compelling story: 83 million active addresses have doubled year-over-year, reaching true mainstream scale. Perhaps most impressively, $12.3 billion in stablecoin supply — with 3 million daily users driving actual payment usage — proves the infrastructure is already battle-tested and ready for mainstream adoption.

This data definitively proves Solana delivers Web2-level user experience today. The infrastructure isn’t coming — it’s here. Each stablecoin dollar drives 8x more transaction volume than on Ethereum, demonstrating superior efficiency and actual user engagement rather than idle capital sitting in wallets.

Alpenglow: Making the Technology Invisible

The upcoming Alpenglow upgrade in Q1 2026 will eliminate all remaining user experience friction, making blockchain verification completely imperceptible to end users. The community has achieved unprecedented consensus, with 98% validator approval in September 2025 demonstrating network-wide agreement on the upgrade path.

The performance improvements are transformative. Finality drops to 150–200 milliseconds — faster than traditional credit card authorization. Throughput increases to 10,000+ TPS, easily handling any retail demand scenario imaginable. At 150 milliseconds, blockchain verification becomes completely imperceptible to users — indistinguishable from traditional payment systems.

The strategic advantage for first movers cannot be overstated. Early implementations using Alpenglow will establish competitive moats before competitors can launch comparable solutions. The technology gap is real, measurable, and growing.

Stablecoins: The Payment Rails Are Ready

The infrastructure for instant Insumer rewards already exists today through Solana’s proven stablecoin ecosystem. Solana stablecoins represent $12.3 billion in value, generating 8x more transaction activity per dollar than Ethereum equivalents. With 3 million daily users processing $295 billion in total transfers, the payment rails are battle-tested and ready for mainstream adoption.

USDC dominates with 72% market share, providing institutional stability and widespread acceptance. The infrastructure is mature, reliable, and used by millions of people every single day.

A practical example illustrates the economics: 5% cashback on a $50 purchase equals $2.50 in instant rewards, delivered for less than one cent in transaction costs. This creates sustainable unit economics that actually work for both businesses and consumers, at scale.

The critical insight: while Ethereum’s high costs mean stablecoins often sit idle in wallets, Solana’s efficiency enables active payment usage, proving the infrastructure is ready for the Insumer Model™’s requirements today, not tomorrow.

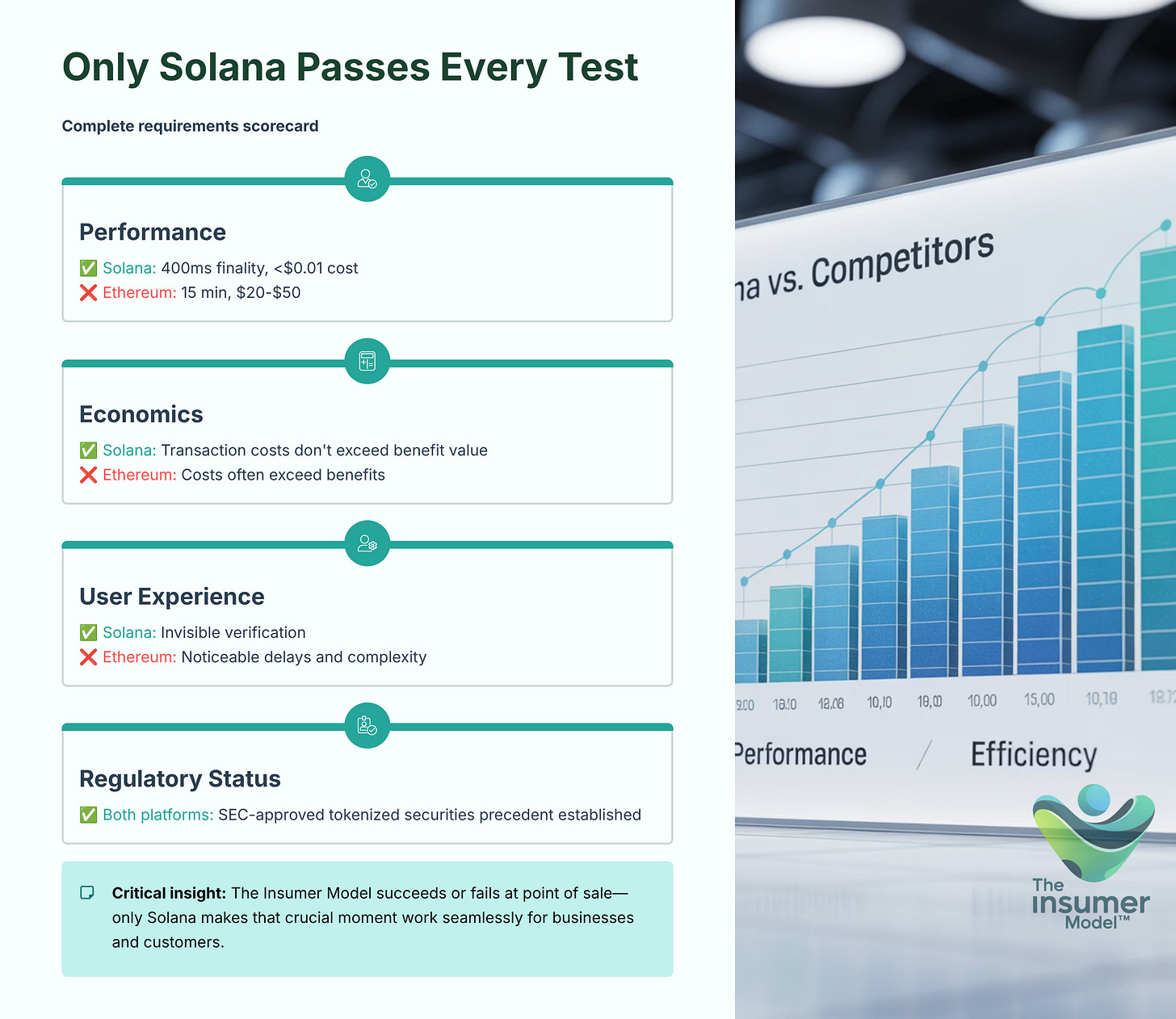

The Complete Scorecard: Only Solana Passes Every Test

When we evaluate both platforms against the actual requirements of the Insumer Model™, the results are unambiguous. On performance, Solana delivers 400ms finality and sub-cent costs, while Ethereum requires 15 minutes and $20-$50 fees. On economics, Solana’s transaction costs never exceed benefit value, while Ethereum’s costs routinely exceed the benefits being delivered. For user experience, Solana provides invisible verification, while Ethereum forces noticeable delays and prohibitive complexity on users. On regulatory status, both platforms now have SEC-approved tokenized securities precedent established — the playing field is level.

The critical insight bears repeating: the Insumer Model succeeds or fails at point of sale. Only Solana makes that crucial moment work seamlessly for businesses and customers alike. This isn’t a marginal difference — it’s the difference between a functional business model and a fundamentally broken one.

The First-Mover Advantage Window Is Open

An 18–24 month competitive moat exists for early implementers who move decisively. This window won’t remain open indefinitely. Customer lock-in through authentic retention creates lasting advantages — when customer-owners develop real equity ownership rather than artificial loyalty program points, they create genuine retention that’s difficult for competitors to break.

Network effects compound across multiple Insumer businesses as customers build diversified ownership portfolios across brands and categories. Timing advantage matters because Alpenglow’s Q1 2026 launch creates ideal timing for maximum competitive advantage and technical superiority. Market position becomes defensible when traditional loyalty programs become obsolete once competitors offer genuine ownership instead of mere points.

The strategic question is simple but urgent: will you lead your category or scramble to catch up? The performance gap gives Solana implementations an 18–24 month head start that could define market leadership for years to come.

What Needs to Happen Now

For businesses, the path forward is clear: begin tokenized equity planning immediately. The technology is proven, regulations exist, and competitive advantages are real and measurable. Don’t wait for perfect clarity — the opportunity exists right now.

For developers, the opportunity is equally compelling: build on Solana now, because superior performance unlocks previously impossible business models and positions you to establish industry standards before the competition arrives.

For investors, the thesis is straightforward: position portfolios for superior customer economics, because early Insumer implementations will demonstrate clear advantages in retention and engagement metrics that translate directly to business performance.

The implementation timeline is concrete: Alpenglow launches Q1 2026, so organizations should start planning now to launch with maximum competitive advantage and technical superiority. Available resources are ready for deployment — regulatory compliance partners, experienced Solana development teams, and complete tokenization infrastructure are available for immediate deployment.

Why This Transformation Matters

The separation between ownership and consumption is ending. This represents a fundamental shift in how markets function, not just an incremental improvement.

Tokenization eliminates the century-old artificial separation between owning and consuming, creating natural alignment of interests between businesses and their customers. Platform evolution shows clear progression: Bitcoin democratized digital value, Ethereum enabled smart contracts, and Solana delivers mainstream infrastructure for mass adoption of genuinely transformative applications.

The Insumer Model represents the first of many innovations requiring Web2-level blockchain performance at scale. This is just the beginning — once blockchain performance matches or exceeds traditional systems, entirely new categories of applications become possible.

The profound insight: once customers experience instant ownership benefits with every purchase, they won’t accept alternatives. The great smart contract platform transition has begun, and early movers will define the new landscape for years or decades to come.

Your equity can live in your pocket, working for you every day

The technology is ready. The regulations are in place. The competitive advantages are measurable and real. The only question remaining is: who will move first to capture them?

Douglas Borthwick

Creator, Insumer Model™ | Author | 25+ Years Financial Markets